MARKET PLUMMETS, VOLATILITY SOARS

Popular options strategies are crushed. Weekly credits lose 68%, calendars lose 52%.

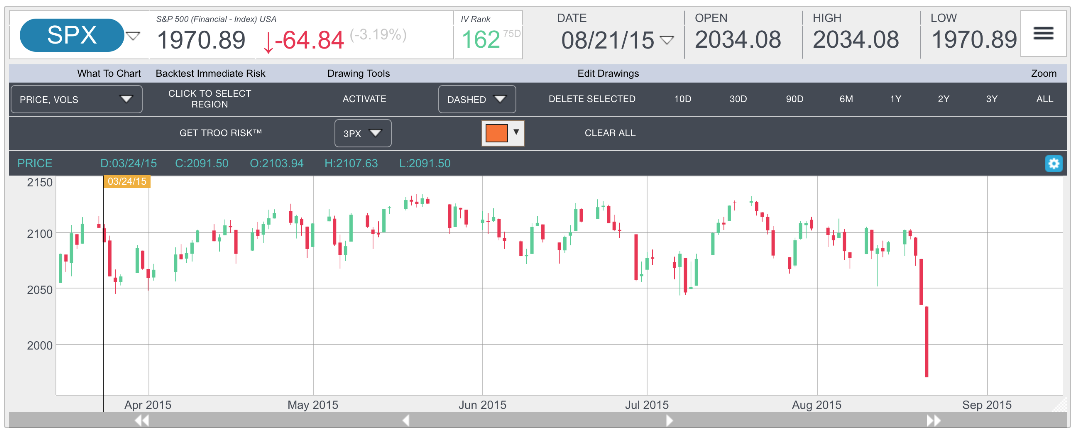

SPX BEGINS TO FREE-FALL (8/17/15 – 8/21/15)

Popular Strategies Sustain Huge Losses During Global Blood Bath

We’ve seen it happen over and over again for decades, but more often than not, option traders choose high probability trades without considering the risk. Once again, the most popular options strategies were crushed, causing millions of dollars in losses to option traders worldwide.

It’s been a long-time overdue, and the market pullback is finally under way (this article written 8/24/15 but always a good lesson). What’s this mean to most option traders? To be blunt, for most it means years of profits will be wiped out in a matter of days. Why does this happen? Let’s take a closer look.

The most popular options strategies of all time have no downside protection, similar to long stock. What are these? I’ll name a few: iron condors, bull put spreads, naked puts, put ratios, covered calls, calendars, diagonals, butterflies, collars, short straddles and short strangles.

Although these popular strategies attract millions of option traders, they are poorly designed trades with enough embedded risk to them that they can blow up your account in only days during a market meltdown. This happens several times each decade. In the last 10 years, this is the 4th significant market move, 2008, 2010, 2011, and now 2015. If you use these strategies, you have to know how to manage the black swan events. If you do not, you should not trade them. The problem is that sometimes even if you know what to do, you cannot. Markets gap and sometimes it’s too late to get filled.

Another way to trade through these inevitable market debacles is to use more sophisticated trading methods and remove the weaknesses of these strategies altogether. For example, learn to use vomma and vanna to dynamically manage your vega. Learn to manage speed so your gamma remains flat. If these terms sound unfamiliar to your ears, then you might want to learn a bit more about options before investing your money. Higher order Greeks are the foundation of all options trading. Trade without the knowledge, and you’ll run into problems.

The most popular options strategies of all time have very little thought put into their design. Just because they are popular doesn’t make them good.

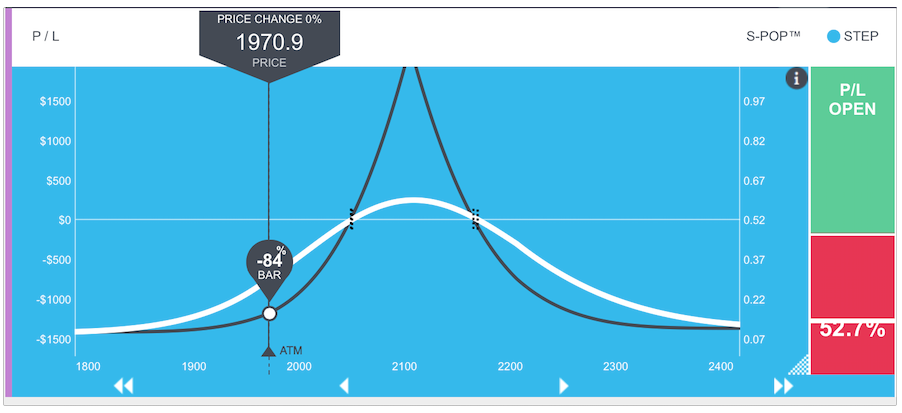

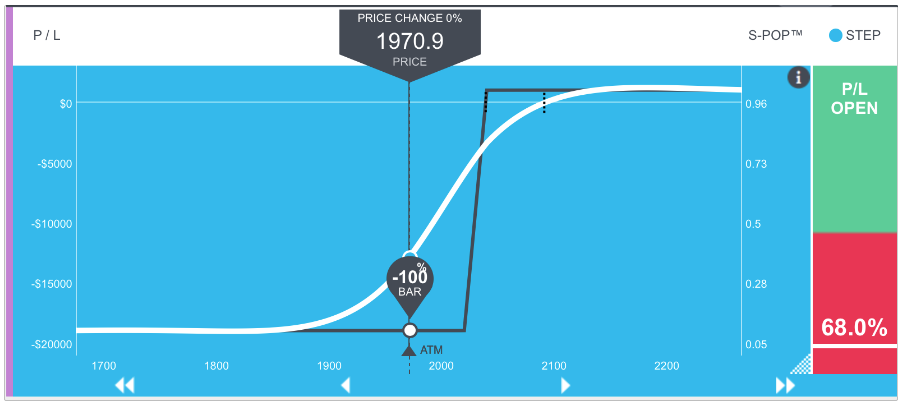

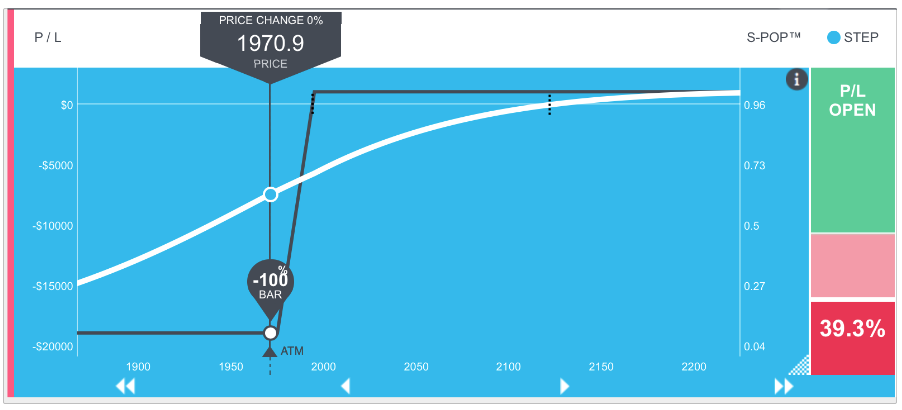

Calendars and Credit Spreads Take Blood Bath

30 Day Calendar Spread. Although positive vega, the trade’s gamma position cannot handle large moves. This trade experienced a 52.7% loss last week even though IV increased.

Weekly Credit Spread Loses 68% during this week.

Monthly Credit Spread Loses 39% during this week.

Please be careful. Options trading can be very rewarding, but for most, it ends up being the worst decision they ever made. This is the reason. Although these strategies may seem like a good idea, they expose you to great risk. Don’t rely on probabilities alone. You must focus on risk management even more. Once you learn to remove much of the risk from your trades, then your probability of success will increase. Most option traders have this concept backwards.

Thank you for reading and good luck with your trading!