Take A Tour

The San Jose Options Max Safety and Max Reward strategies combined with OptionColors™ patent-pending options trading software platform, give you the best chance to becoming a successful option trader. We have proven this year after year. If you are tired of small winners followed by tremendously large losses, then read on…

I am delighted to be associated with Morris and San Jose Options. The program is the best that I have found, and it’s by far the best value out there as well without exception. The people out there have no idea what they are missing. My account is pushing $100K again. It has been bouncing around quite a bit, but as it does, I am using the SJ Options Method to lock in more and more. After 25 years of active investing I could not be happier than I am now.”

I have been nothing but excited and happy about my decision to sign up with San Jose Options. I must say that this course is the real thing. It really works! he will teach you how to apply the material; when and how to execute the trade, follow the trade, adjust the trade and close the trade. Most importantly to help you keep your trading account or 401K from huge drawdowns. I have never, even written an endorsement for any course in the past, but I gladly do this for San Jose Options.

I have built a system to trade the ES Futures, but I had to use stops, which were getting hit too often, and this became very frustrating. I have found with your strategies, I don’t need to be perfect with timing. Yours are so forgiving and less stressful because the system can actually be wrong or the timing off and you can still make money! The strategies you teach may not seem easy until it clicks, and then their simple elegance becomes apparent.

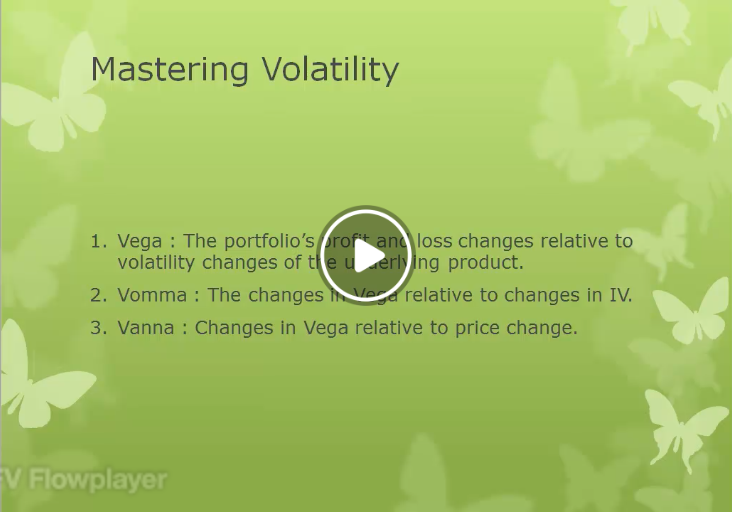

Vomma is used to dynamically manage Vega, and since Vega is so crucial to your success as an options trader, it’s a given that you must learn to manage Vomma. What is Vomma anyway? It represents how your Vega position will change relative to changes in IV. Studies indicate that profits and losses are 6X more sensitive to Vega than Theta. Isn’t it time you learn to manage your Vomma?

Although 99.9% of all option traders do not know how to manage Vega and Delta, they trade options anyway, putting their capital at risk. Academic studies show that delta-vega hedging reduces risk of 50% or greater on short straddles, strangles and other advanced options strategies.

Managing delta alone increases losses by 200% according to doctorates in physics. Propel your Greek management skills to higher levels with SJ Options.

This is a good class on volatility trading, which is essential education for all traders who seek long-term success with options. To master volatility trading you have to understand Vega and how to manage it with Vomma and Vanna. We look at the put front ratio spread for a net credit, which is an example of a trade structure that’s designed fundamentally incorrectly relative volatility behavior.

At first glance, this ATM put ratio appears to be an excellent trade setup, so we dive deeper into how its engine actually runs. Is the risk really worth the $1,200 credit? Find out in this deep analysis of its vega Greek structure.