Why Karen The Supertrader’s Fund Lost Money Year After Year

After creating years of buzz through advertising by tastytrade that Karen Burton was profiting millions from short strangles, the SEC stated, “Karen the Supertrader’s Winning Strategy Relied on Fraud.” If you read the SEC report, you will find that each month when she was losing, she sold a 3 DTE calendar spread, to post realized gains on the short strike, to cover up the losses.

The full article can be found here: https://www.thestreet.com/story/13593247/1/karen-the-supertrader-s-winning-strategy-relied-on-fraud-sec-alleges.html

The complete SEC report: https://www.sec.gov/litigation/complaints/2016/comp-pr2016-98.pdf

Karen’s Core Method, The Short Strangle

According to the numerous interviews posted by tastytrade, Karen’s fund was concentrated in SPX short strangles, a tastytrade favorite. If you had an opportunity to watch the interviews, you would have noticed that Karen had very little understanding of option Greeks and their associated risks. I don’t blame her for that. I consider her a victim in many ways, which I will discuss throughout this article.

Karen’s approach to options was selling premium a percentage OTM near 58 DTE (days to expire) and managing her margins, but there are a myriad of things she did not understand about options, which put her in serious danger. She took the approach of high probability of profit (POP), which is a very common way to trade options. It’s really the first thing most option traders learn. It appears her fund lost over $100,000,000 from what I can gather so far through public records.

The short strangle strategy is one of the most risky options strategies of all time, and in this article, we revisit the risks of this options strategy to clarify why Karen’s fund did not have long-term success with this method, and once again, we want to make the public aware of the risks involved with this overly-advertised options strategy.

Directional Risks of Karen Burton’s Core Strategy, Gamma

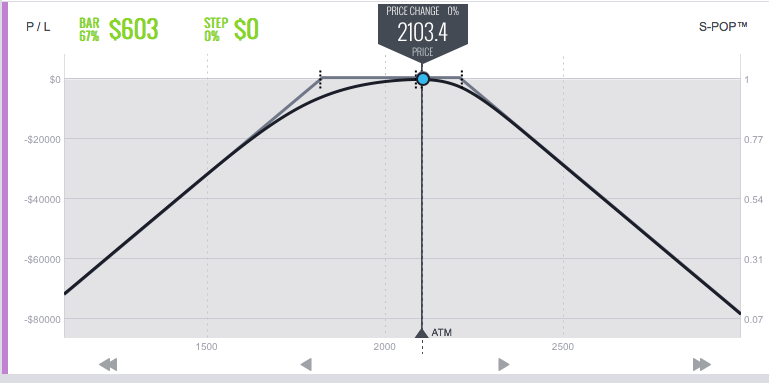

The short strangle has tremendous directional risk. As the SPX goes up, it loses money. As the SPX falls, it loses more money. This strategy has a strong -Gamma position, meaning the Delta is constantly changing against the trade. This creates instant losses when the underlying moves and forces the trader to make many adjustments.

Volatility Risk, Vega

The short strangle carries a very over-leveraged short Vega position, which means it theoretically profits as volatility decreases and loses as volatility rises. Many option traders trade short Vega strategies, but the short strangle is not like other short Vega methods, and the difference is commonly overlooked. It has to do with Vomma.

Accelerating Vega Risk, Vomma

The problematic short strangle carries a short Vomma position, which causes the short Vega risk to accelerate as implied volatility rises. With short Vomma, the short Vega becomes more negative as IV increases. This means each time the SPX falls and IV increases, such as on August 24, 2015, the short strangle experiences losses far greater than expected. Vomma, a higher order Greek, is essential understanding for every serious option trader, but unfortunately, the higher order Greeks are seldom taught in the industry, and Karen became a victim of this. SJ Options and SJ Advisor do teach higher order Greeks and have been for nearly a decade now, but unfortunately, we did not have the opportunity to train Karen and her team.

Unstable Portfolio Margins Increase Quickly, Trade Sizing

In order to trade a portfolio margin (PM) account successfully, you have to match a strategy with PM that will provide you with stable margins. The short strangle is not a good match for portfolio margin accounts because margins go through the roof each time the underlying falls quickly. A good PM strategy will not cause margins to fluctuate so much during volatile markets. According to the empirical data we collected over decades of backtesting the short strangle, the only way this method could produce profits long-term is to trade very small, under 15% of the account value. At 50% margins, which Karen was using, our studies showed this trade would have lost about 44% over 11 years with one adjustment system. The other test we performed resulted in a loss of 80% over the 11 year span. Karen’s performance fell within our expected range.

Karen’s volatile strategy should have resulted in increased margins of up to 200% at times, forcing Karen to close trades at millions of dollars in losses. It’s very possible on August 24th alone, her fund lost over $50,000,000. Matching the wrong strategy with a portfolio margin account had Karen exposed to risk she was not fully aware of. She believed she could manage anything thrown at her, but she was wrong. Managing a short strangle of hundreds of millions would be laboriously demanding if not impossible even for the most advanced traders. The Delta position changes fast, the Vega changes even faster and margins can double in a heartbeat.

Rolling Out Farther In Time, Bad Adjustment System

Each time Karen was margined out due to large moves in either direction, she rolled the naked positions farther out of the money and in time. As illustrated by her fund’s performance, this is not an effective adjustment system. This is a poor choice of money management and often times leads to larger and larger losses.

Example of Karen’s Trade (15,000 Naked Strangles, – 2 Million Vega and -140,000 Vomma)

Karen’s trade required approximately 15,000 naked puts and naked calls. The negative Vega position that was created amounted to approximately -2,000,000, but what’s also very noteworthy about this trade is that it also formulates a negative Vomma position of approximately -140,000. Vomma represents how the Vega position will change relative to the changes in the implied volatility of the underlying asset. In this case if the VIX rises five points, then the Vega position will change to approximately -3,000,000, an increase in Vega risk of 50% or 1 Million -Vega points.

How Margins Increase

As you can see this trade contains an extremely strong negative Vega position, and behind the negative Vega is also a very powerful negative Vomma position, so as the market falls and the volatility rises, the losses of the short strangle accelerate. This explains how Karen could have run out of buying power unexpectedly during August 2011 (as she stated in a video), and the same thing could have happened again on August 24th of 2015. As the market fell and the -Vega and -Vomma kicked in, the -10% margin went through the roof nearly instantly. In modeling this trade after a 10% drop in price and shocking the portfolio with a 13 point rise in implied volatility, the margins would have changed from $100 Million to approximately $220 Million. If Karen the Supertrader was managing $200 Million, she could have lost her buying power for this reason.

IV to Price Correlations

In another study I found there is an average inverse correlation of price action to volatility shifts of around 8 for a fast market move. This means if the SPX drops 200 points, then it’s corresponding IV rises approximately 25 points. I modeled a 25 point increase in volatility on this trade, and it loses approximately $150 Million if this happens.

Value at Risk

As you can see the extremely powerful negative Vega combined with an intensive negative Vomma position can result in catastrophic losses for this trade design if there is a sudden volatility shock applied to the portfolio. With Karen’s fund investing 50% of the capital, they could lose approximately 75% of the portfolio in the event of such a volatility shock if they are not hedging.

Before you attempt this trade with your own capital, be aware that not only is the trade negative Vega, but as the market falls, the negative Vega accelerates because of the negative Vomma. This is why it’s so important to understand higher order Greeks and how they relate to your trading.

Lack of Backtesting, R&D

Finally, Karen is also a victim of the lack of proper options analytics. She was using antiquated and obsolete Thinkorswim, and that platform does not have what’s needed to manage complex options positions. It also lacks the backtesting tools that Karen or any fund manager should have to fully complete the research and development phase. Karen’s system obviously was not fully tested, and it was not well thought-out.

Karen probably believed she had all the tools she needed to succeed, and I don’t blame her for that either. It’s easy to be misled by companies that can afford commercial time every 5 minutes, even on the NFL Network! Every where you go, “Luck is in the air.”

Summary

I believe that Karen Burton had good intentions, but the option strategy she deployed consisted of risks that she did not fully understand. From watching her interviews, she did not seem to acknowledge volatility risks, and I’m most certain she was not aware of the negative Vomma position of the short strangle.

The negative Vomma position, combined with the negative Gamma attribute of her core method, created unstable margins and tremendous exposure to margin calls each time the market moved down.

She quickly ended up in an uncontrollable situation, and for whatever reason, she decided to cover-up the losses, hoping her fund would recover over time.

I performed decades of back tests on the short strangle, matching Karen’s formula and tastytrade formulas as closely as possible many months ago. The systems did not perform well in the back tests. I had no idea that Karen’s fund was actually losing money when I performed the back tests, but the tests did reveal the truth of the methods, showing they would blow up an account when large amounts of margins were deployed. The public was in disbelief when I announced the results of the short strangle back tests, but now maybe they will change their opinion.

SJ Options specializes in advanced trading education and risk management by higher order Greeks. For more information about our training, please attend our free events, and if you manage a fund, please feel free to contact us about our advisor training program and advanced software analytics, fully developed with higher order Greeks and more.