Trading Options Over Volatile Markets

When markets are calm, option traders typically have time to react and make adjustments to their portfolios. However, when markets become volatile and gap, most option traders are exposed to great losses. The difference between your average option trader and your advanced is their knowledge of higher order Greeks.

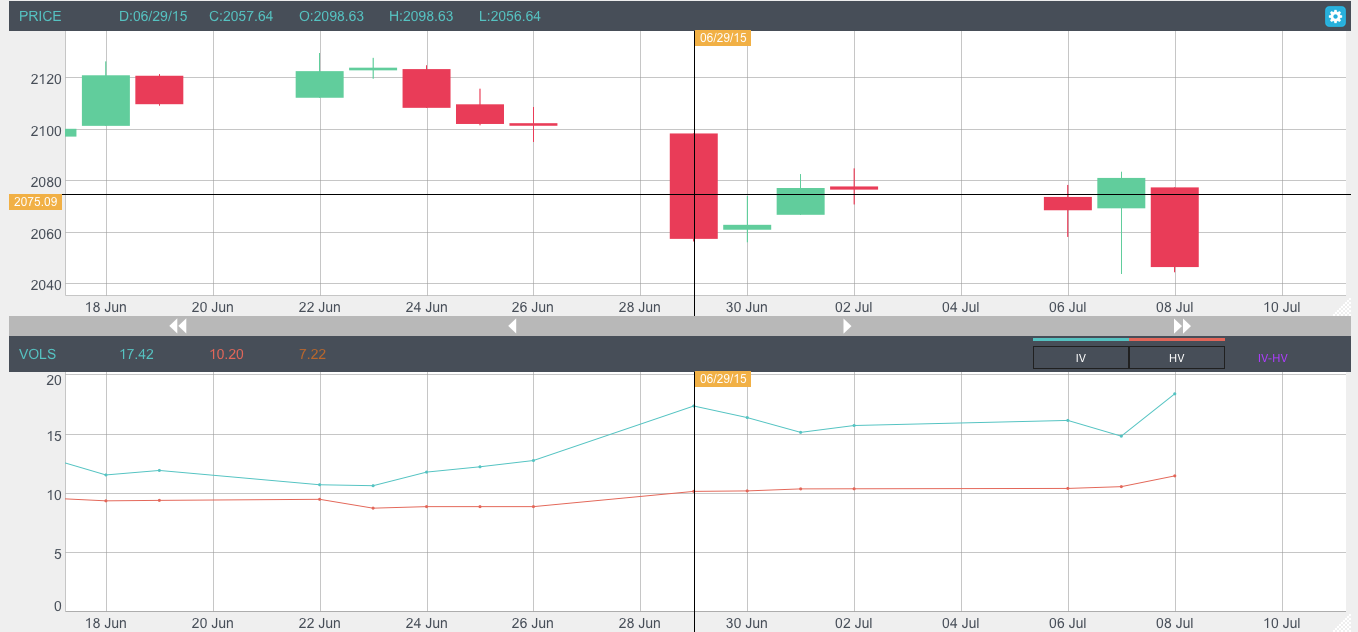

Recent market moves indicate more volatile times are ahead. On June 29th, 2015 the SPX fell 2% from the previous close. This was a large move for such a low volatility environment. A few days later the SPX fell again nearly 2%.

During a short period of time the implied volatility of the SPX increased 70% from about 10 to 17.

See price and volatility chart below:

What Does This Mean For Option Traders?

To most traders this brings confusion to their trading plan. Statistics indicate that most option traders use covered calls, bull put spreads, naked puts and iron condors. What do all of these strategies have in common? They are all exposed to volatile markets, especially market declines.

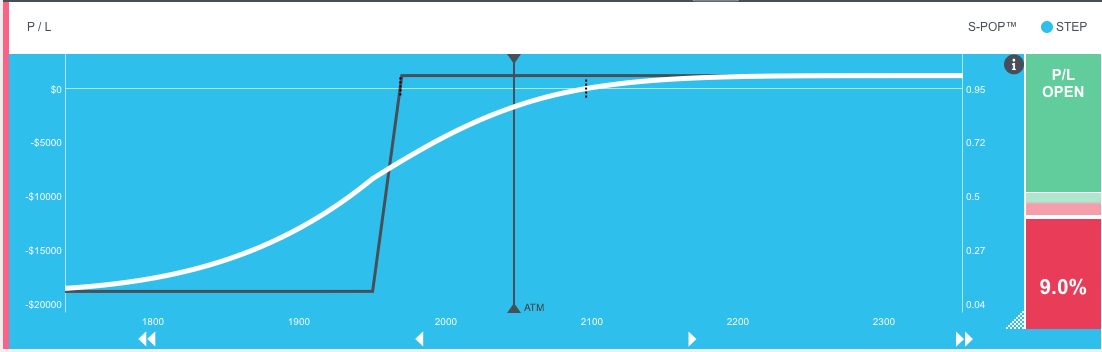

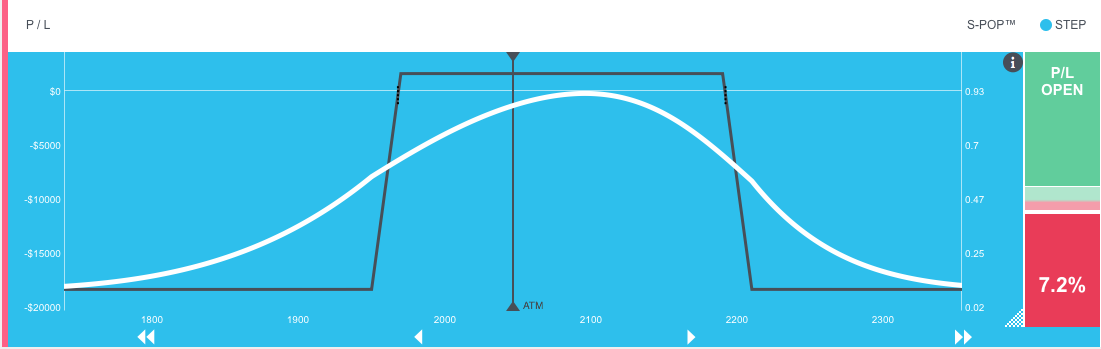

For example, over this very small market pull back, these strategies took a hit. Here we see what happened to the bull put spread and iron condor from 6/29/15 to 7/8/15.

-10 Delta Bull Put Spread 30 Days Out From Expiration (Drawdown of 9%)

10 Delta Iron Condor 30 Days Out From Expiration (Drawdown of 7.2%)

Understanding Higher Order Greeks Can Improve Trading Results

Both of the above trades have a strong negative gamma and negative vega. This means they lose money when implied volatility increases combined with a price move of the underlying asset. In order to improve safety through option trading, it’s important to know how to modify your higher order Greeks.

For example, you could flatten gamma and vega so your options can handle volatile markets. You could also take advantage of lambda if you knew how to. If you understood vomma, you could have better control over your vega position and the same goes with vanna. Also, the charm of the credit spread and condor work against you. There are many internal Greek problems with these popular trade setups.

The methods used by SJ Options implement knowledge of higher order Greeks. Our trades went right through this pullback without any issues. In fact, we closed out more winning trades! Through better understanding of options, we design our trades to perform in normal market conditions and to be safe at the same time, when the calm markets wake up and do what they do.

Check out our Performance page to see how we did!

Think smart and trade safer with SJ Options.