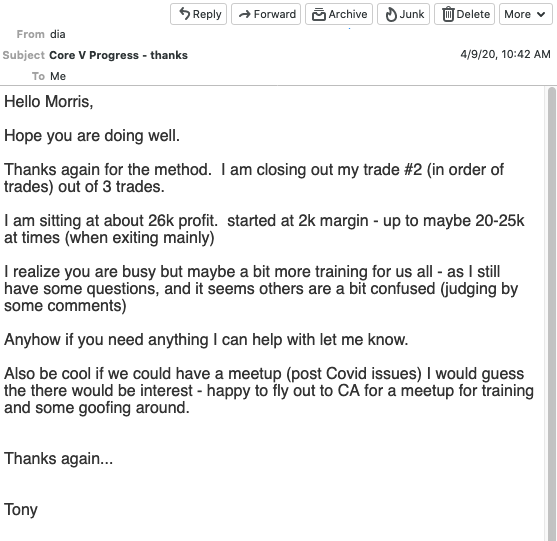

Hello Morris,

Hope you are doing well. Thanks again for the method. I am closing out my trade #2 (in order of trades) out of 3 trades. I am sitting at about 26k profit. started at 2k margin – up to maybe 20-25k at times (when exiting mainly).

I realize you are busy but maybe a bit more training for us all – as I still have some questions, and it seems others are a bit confused (judging by some comments).

Anyhow if you need anything I can help with let me know. Also be cool if we could have a meetup (post Covid issues) I would guess the there would be interest – happy to fly out to CA for a meetup for training and some goofing around.

Thanks again…

Tony

Original msg below: