SPECIAL ANNOUNCEMENT!

Soon, OptionColors™ options analytical software, will be available without the SJ Options membership. We’ve had many requests for this, so we’ll be offering OptionColors™ starting this September to non-SJ Options members.

OPTIONSCOLORS™ HISTORY

OptionColors™ is a revolutionary options trading platform designed by founder Morris Puma. OptionColors™ development began in 2007 and includes more statistics and volatility calculations than any other platform in the world. As an example, OptionColors™ has approximately 20,000 more volatility charts for SPX compared to the industry standard software. OptionColors™ software performs millions of volatility calculations each day for our clients to study and to locate trading opportunities. OptionColors™ technology is not available in any other platform.

MARKETS ARE COMPETITIVE

The stock market is very competitive and option traders require a serious edge to succeed, and that is exactly what Morris brings to the world today – OptionColors™, the platform with the most beneficial information ever delivered to option traders. With OptionColors™, traders can finally see the true colors of options.

Morris has taken a scientific approach to option trading analysis, and he’s very excited to share his inventions with the world coming this September through his industry-changing platform, OptionColors™.

TESTING OF OPTIONCOLORS™

We’ve been developing and testing OptionColors™ for many years now, and with all its patent-pending features, its technology reflects an ability to increase returns and trading safety. OptionColors™ includes a new intelligence that has never been presented to traders. It’s the first trading platform that truly gives traders clear information they need to make logical, statistical decisions.

OptionsColors™ has been used to select and manage 156 winners of 157 trades, witnessed by the SJ Options community since 2014. That’s a 99.3% win rate. The only loss we experienced during the test period was about 1.1%. Even though this has been a test only, the results are ground-breaking and very significant. We could not have replicated this success with any other platform in the world, and we are sure to continue with winner after winner. Using the platform we believe we could go 999 for 1,000 trades as we continue our test, but why do it alone? We’re ready to share our logic with the world.

WHAT’S SO SPECIAL ABOUT OPTIONCOLORS™

OptionColors™ is full of inventions. It’s a totally new approach to analyzing options. With OptionColors™ we can see how every option behaves. There is no other platform in the world like it. Our founder, Morris Puma, has redesigned options analytics from the ground up. Some of his patent-pending inventions include:

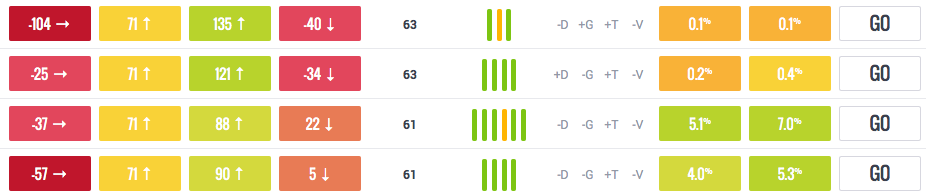

- Daily Insight™ – Revolutionary option chain that helps traders understand options better and to construct more intelligent trades.

- OptionCharts™ – Crucial volatility charts that traders need to model trades quickly and accurately.

- Tsunami™ – Statistics converted to future probability calculations (S-POP™).

- Trade Assistant™ – Builds optimized option spreads for increased returns over and over again.

- Higher Order Greeks – Calculations and charts to improve risk management for sophisticated option traders.

- Timeline™ – Review trades like never before, like watching a glass engine run.

- Up or Down™ – Forecast volatility changes on thousands of tickers in seconds.

- Ticker Picker™ – Scan tickers based on advanced volatility calculations, price changes and more.

To get started in September please schedule a personal demo. We’d be happy to answer all your questions during our demo time. We look forward to showing you the OptionColors’ logic and how it can increase your trading safety and returns.