Karen The Supertrader

Youtube has created a lot of buzz around the options trading community about Karen the Supertrader. People wonder if the said profits are true or not, but today we’re not here to post our opinions on the returns, but rather we’re going to look at the risk involved in the strategy that was presented in the tastytrade videos on Youtube.

It’s very important to alert the public of the true risks involved in short strangles because in the interviews the risk is not discussed as much as it should be. Because of the excessive media exposure, there are many of retail traders attempting to trade this uncovered options strategy that has nearly unlimited risk potential.

High Risk Equals High Maintenance

In an interview with Tom Sosnoff, Tom mentions Karen’s fund made over 50,000 trades in one year. That is 137 trades per day. Karen also confirmed that her company day trades the legs of her naked strangle many times. It sounds like they are buying and selling all day long, each day.

The naked strangle is not a set-it and forget-it type of trade. It’s very similar to the Iron Condor, with tremendous directional risk in either direction, and it requires constant adjustments to maintain safety. Karen states they are trading all day long. Please be aware that the short strangle is totally exposed to a flash crash. If that happens, it loses and it loses big.

The Method

The method is described as selling puts when the market drops, and then buying them back when the market rises during the day. When they are wrong, they wait and role out farther in time if they need to. They do the same thing with the call side. It’s not much different than day trading stock each day but with additional leverage and volatility risk. In fact, she also states that they manage each leg separately, which confirms they are buying and selling single contracts, not spreads.

When Does the Naked Strangle Perform Well?

Although not mentioned in her interviews, the naked strangle is a very strong negative Vega and negative Vomma trade. This trade gets hammered when volatility rises and profits quickly when volatility drops. The reason they made so much in 2012 and 2013 is because volatility was dropping after the 2011 market crash. In both August of 2011 and 2015, the short strangle experienced severe drawdowns.

Warning! Portfolio Margins Change Fast

The margins can instantly sky rocket for short strangles, forcing you to close trades at a loss. Most portfolio margin systems do not calculate volatility changes. IV does not remain constant, but brokers use this form of risk model. This puts you into great danger if you trade short strangles on a portfolio margin account. One moment your margin balance is in check and the next you have a margin call. Margins at brokers are very unstable for this type of trade.

Margin Calls

If you watch the videos closely, then you will notice that Karen stated that she could not trade for some reason during August of 2011 because her buying power instantly vanished. Tom Sosnoff quickly changed the subject during that awkward moment. Most likely this happened because volatility increased, her net liquid dropped while margins increased all at the same moment, creating a margin call.

Higher Order Greeks

Looking through the blogs online about this topic, there isn’t too much discussion about the higher order Greeks and how they relate to this trade. I just did some modeling in our software, and I would like to share the results with you.

I modeled a 56-Day naked strangle selling far out to the money contracts, near the 4 Delta of the puts and the calls. I created a trade that would require $100 million dollars of margin using a + / -10% risk array calculation, which is commonly used on Think or Swim. This would be about 50% of her account, which I read online she is trading.

15,000 Naked Strangles, – 2 Million Vega and -140,000 Vomma

This trade required fifteen thousand naked puts and naked calls. The negative Vega position that was created amounted to approximately -2,000,000, but what’s also very noteworthy about this trade is that it also formulates a negative Vomma position of approximately -140,000. Vomma represents how the Vega position will change relative to the changes in the implied volatility of the underlying asset. In this case if the VIX rises five points, then the Vega position will change to approximately -3,000,000, an increase in Vega risk of 50% or 1 Million -Vega points.

How Margins Increase

As you can see this trade contains an extremely strong negative Vega position, and behind the negative Vega is also a very powerful negative Vomma position, so as the market falls and the volatility rises, the losses of the short strangle accelerate. This explains how Karen could have run out of buying power unexpectedly during August 2011, and the same thing could have happened again on August 24th of 2015. As the market fell and the -Vega and -Vomma kicked in, the -10% margin went through the roof nearly instantly. In modeling this trade after a 10% drop in price and shocking the portfolio with a 13 point rise in implied volatility, the margins would have changed from $100 Million to approximately $220 Million. If Karen the Supertrader was managing $200 Million, she could have lost her buying power for this reason.

IV to Price Correlations

In another study I found there is an average inverse correlation of price action to volatility shifts of around 8 for a fast market move. This means if the SPX drops 200 points, then it’s corresponding IV rises approximately 25 points. I modeled a 25 point increase in volatility on this trade, and it loses approximately $150 Million if this happens.

Value at Risk

As you can see the extremely powerful negative Vega combined with an intensive negative Vomma position can result in catastrophic losses for this trade design if there is a sudden volatility shock applied to the portfolio. With Karen’s fund investing 50% of the capital, they could lose approximately 75% of the portfolio in the event of such a volatility shock if they are not hedging.

Before you attempt this trade with your own capital, be aware that not only is the trade negative Vega, but as the market falls, the negative Vega accelerates because of the negative Vomma. This is why it’s so important to understand higher order Greeks and how they relate to your trading.

Public Information on Karen the Supertrader’s Fund : Hope Advisors

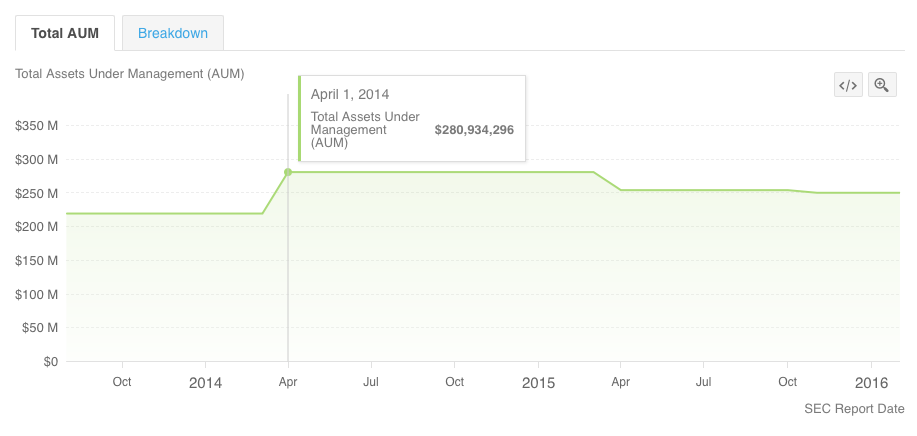

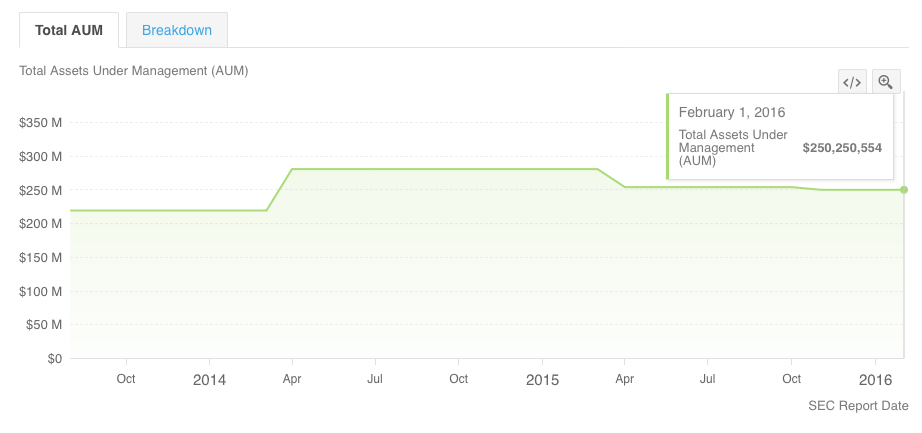

Below you will see that this fund has lost $30 Million since April of 2014 according to public records. Please note, we are not here to speak negatively about her fund in any way. We just want to clarify that the short strangle is not as simple as people think. We’d like to work with Karen’s fund in the future and help her turn around this performance.

In the next image you will see her fund has lost $30 Million AUM since April 1, 2014.

Sum it Up

The short strangle is not as easy as it appears to be. Margins change quickly and it’s vulnerable to quick losses and margin calls. Be very careful with this strategy. We conducted an 85 year backtest of the short strangle, 45 days to expiration, and it lost money overall.

SJ Options specializes in advanced trading education and risk management by higher order Greeks. For more information about our training, please attend our free events, and if you manage a fund, please feel free to contact us about our advisor training program and advanced software analytics, fully developed with higher order Greeks and more.