High IV Rank VS Low IV Rank Credit Spreads

Do High IV Rank Credit Spreads Outperform Low IV Rank Credit Spreads?

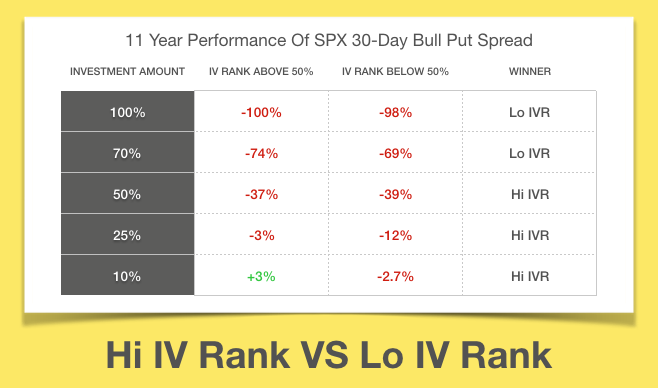

Tasty Trade claims that traders have a huge advantage when selling option premium when IV Rank is 50% or higher. We ran a back test from 2005 to 2015 using SPX to validate their claim.

Here are the rules for our 11 year-long back test:

-

SPX is underlying

-

30 DTE (Days to Expiration)

-

Sold near -.10 Delta Put

-

Bought near -.07 Delta Put

-

No Management Rules (Start Trade and Rely on Probability)

-

IV Rank from 0 – 50% tested

-

IV Rank from 50 – 100% tested

-

2005 to 2015 back tested to compare performance

IV Rank (50% to 100%) VS IV Rank (0% to 50%)

Our back test reveals that there is no advantage to selling credit spreads when IV Rank is above 50%.

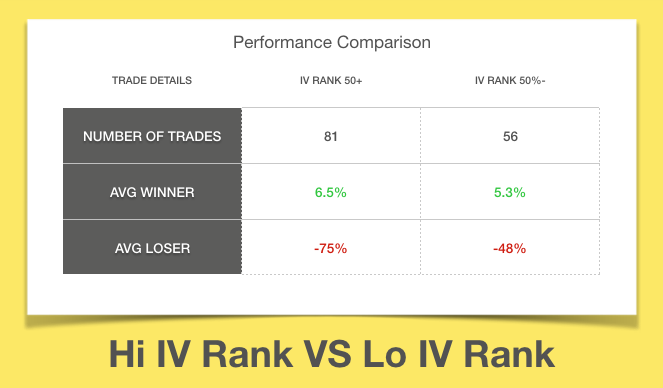

Breakdown of Trades

This table breaks down the average winners and losers per IV Rank. We can see that the 50+ IV Rank as an entry signal increases the winning trade average slightly, but the average loser increased tremendously. From this perspective the Low IV Rank appears to be a better entry signal.

Conclusion

SPX credit spreads with IV Rank Under 50% outperformed IV Rank Over 50% in our study. We arrive to this conclusion for 2 reasons:

1. Low IV Rank reduced the average loser by 27% and only reduced the average winner by 1.2%.

2. Low IV Rank, with less risk, allows traders to invest more capital.

Although Low IV Rank is the winner in our study, neither method proved to be a winning strategy.

The only winning trade, investing 10% with high IV Rank, resulted in a 3% return over 11 years and that does not include commissions. After commissions, it also lost money.

The reason for these poor trading results is most likely because as IV increases, so does directional risk. Therefore, there is no advantage to selling high IV the way that Tasty Trade teaches it.

There are in fact ways to take advantage of volatility reversion, but selling premium when IV Rank is 50% or higher is not the answer. We wish it were so simple as they make it out to be, but the truth is, it’s a bit more complex than that.

Disclaimer: We cannot guarantee accuracy of back test or data. Please do your own back tests and make your own conclusions.