Credit Spreads Explained And How To Adjust For Risk

Many investors looking to get into options start with credit spreads after learning basic options fundamentals. This occurs because credits spreads are easy-to-understand and it appears that everybody seems to make money off of this strategy. After all, there are entire options courses out there dedicated to credit spreads. Why wouldn’t you want to try them out.

So we took the liberty to explain credit spreads on a deeper level. No sugar coating. Just the facts.

What is a Credit Spread

A credit spread involves simultaneously selling and purchasing an option in the same expiration month, but different strike prices. The option that you sell is closer to the money or has a higher premium than the option you purchase.

In a nutshell, credit spreads work like this:

Short Options (Cash In) – Long Options (Cash Out) = Credit Spread (Net Cash In)

The short option leg generates more premium to offset the price of the long leg in a credit spread. The net credit is deposited into your portfolio.

The long option is important to credit spreads because it is the portion of the trade that defines the risk. Otherwise, we would have naked short position which has an unlimited loss potential.

There are two types of credit spreads: 1) Bull Put Spread and 2) Bear Call Spread.

Bull Put Spread

This strategy is used when you are expecting a moderate increase in the share price. You purchase an out-of-the-money put and sell a put that has a higher premium simultaneously to offset the purchase of the long put option. This is all done at the same expiration month.

Bear Call Spread

This strategy is used when you are expecting a moderate decrease in the share price. You purchase an out-of-the-money call and sell a call that is closer to the money simultaneously to offset the purchase of the long call option. This is all done at the same expiration month.

Maximum Risk for Credit Spreads

The maximum risk of the credit spread trade would be the difference between the strike price from what you sold and what you purchased. You take that difference and subtract the net credit that you collected from the original credit spread trade.

Maximum Loss = Difference in Strike Prices – Net Credit

Maximum Reward for Credit Spreads

What you originally collected from the credit spread trade is the maximum reward. It’s the difference between the amount you collected between the short option and the purchased long option.

Maximum Gain = Net Credit

Breakeven Point for Credit Spreads

For Bull Put Spreads: Higher Strike – Net Credit

For Bear Call Spreads: Lower Strike + Net Credit

Example Credit Spread

Let’s go over a quick hypothetical example using 1 contract for each leg of the spread.

Let’s say that you want to invest in Buffalo Wild Wings Inc (BWLD). It’s been on your watch list for a while and you notice the stock finally meets your criteria to jump in. After all, it has passed through your stringent technical and fundamental analysis filter.

You take on a bullish stance and believe the stock is not going below $70. Currently, BWLD is trading at $75 (once again, this is hypothetical). After doing some simple support and resistance analysis, you decide that you’re ready to implement a 70 / 65 bull put credit spread.

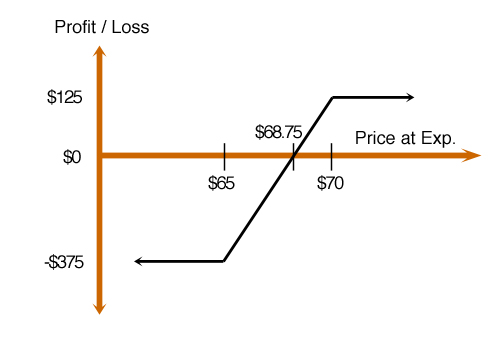

That means you short a put at the $70 strike and purchase a long put at $65 strike simultaneously for the same expiration month. Here’s what the risk profile looks like:

The calculations are very straight forward as shown here:

Selling the 70 Put yields $2.50 ; Buying the 65 Put costs $1.25

Net Credit = 70 Put Yield – 65 Put Cost = $2.50 – $1.25 = $1.25

Maximum Gain = Net Credit = $1.25

Maximum Loss = Difference in Strike Price – Net Credit = $5 – $1.25 = $3.75

Breakeven Point = High Strike – Net Credit = $70 – $1.25 = $68.75

When Maximum Gain is Received

Maximum Gain of $1.25 is received when BWLD trades above $70 at expiration. That comes out to $125 in your pocket for every matching credit spread contract! Essentially, both legs of the credit spread expire worthless leaving the net credit in your account.

When Maximum Loss is Obtained

Maximum Loss of $3.75 is obtained when BWLD trades below $65 at expiration. This is why the ability to call market direction is important. Your maximum loss will generally be much greater than your maximum gain in credit spreads.

Break Even Point

The breakeven point is $68.75. You lose money if the stock price expires below $68.75 and you make money when the stock price expires above $68.75.

Putting It All Together

In the end, there’s no question as to why credit spreads are wildly popular. They are easy to setup and they appear to have a high probability of being profitable. This is especially true if you can consistently call the direction of the market.

In fact, it’s very possible to be profitable in 9 out of 10 trades if you stay conservative with your approach. However, just because the probability is high, it doesn’t mean you can take your hands off the wheel.

One glaring issue is the skewness in risk-to-reward ratio. It’s not uncommon to have a 3 to 1 risk-to-rewards as in our example above (risking $3.75 for a small $1.25 gain). You can go 7 months in a row making a decent 5% gain and lose it all in the 8th month.

That’s a lot of risk to stomach. However, like most options strategies, there are ways to reduce this risk. Here are 3 ways:

Setup your credit spread further away from the money. This gives the stock cushion to oscillate away from the spread.

Leg into the position on the long strike price with a call for bear calls spreads or a put for bull put spreads. This acts as a hedge against further increases in volatility. In Layman’s terms, if you lose on the trade, it won’t be as bad. If the trade, turns completely against you, it’s even possible to make money.

Neutralize the Delta by adding a debit spread to the existing trade. You’ll lock in profits while you stay in the credit spread trade.

At San Jose Options, we do not teach credit spreads as a strategy to use alone. However, we do use them in combination with other spreads and adjustment strategies to make them SAFER to use. Try us out for free and see for yourself why our course is the preferred options program for risk-averse investors worldwide.

Good luck and happy trading!